Martin Lewis gives urgent ‘warning’ to all drivers and says ‘it could | Personal Finance | Finance

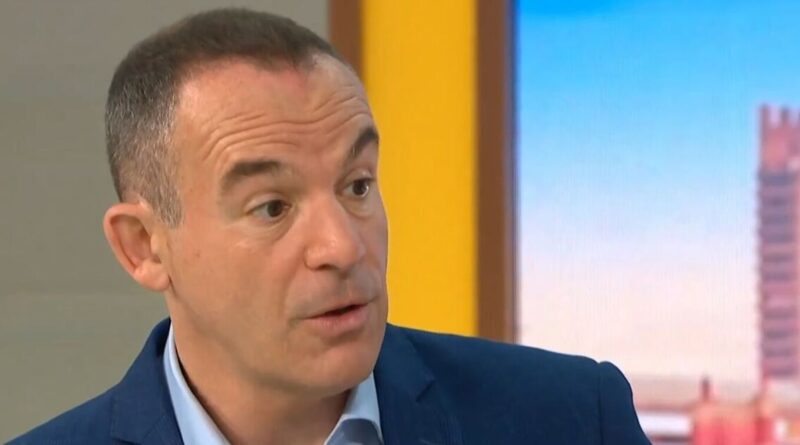

Personal finance expert Martin Lewis has issued a warning to everyone who drives a car – and says it could cost hundreds of pounds. The Money Saving Expert site founder explained that people should seriously consider if paying monthy for car insurance is a good idea.

Taking to social media site X, he explained that if people pay over 12 months instead of a year then in fact it is in fact a loan – and they can be charged through the nose for it including more than many typical credit cards. He said: “WARNING: Monthly direct debit is a LOAN – they pay the year for you and loan you the money often at 20 – 40% APR way more than a credit card. I’m shocked by how many pay by monthly DD. Avoid if at all possible, more help in I should say “way more than a typical high street credit card.”

Mr Lewis linked to the Money Saving Expert site which has a number of tips around car loans including never to auto-renew, how the best time to get car insurance quotes is 20 to 27 days before you need the policy to start, before getting quotes, make sure you’re on the electoral roll – it can affect costs, and for the cheapest policies, you’ll usually need to pay annually.

One follower said that for them it was never that much difference: “It’s only about £15 difference over the course of the year so I prefer that than a relatively bigger chunk disappearing in one go.” However Martin replied: “You must be on a low apr and low premium – for many its £100s.”

Another made the point that since it rose massively, there has been little choice: “I used to pay my car insurance in a lump sum but since the doubling in price I’ve had to pay for it by direct debit, no other choice.” Another appreciated the advice: “Thanks for raising awareness on this. Many people don’t know this and it’s shocking when I hear people are paying monthly for insurance products.”

The perfect time to renew is exactly 23 days before your policy expires, the Money Saving Expert previously said.

He added: “That’s not for your renewal quote, that’s for going onto comparisons to get different quotes.” He revealed insurance companies determine their renewal price based on ‘actuarial risk’ – meaning the longer you leave it, the higher the premium could be.

He found some firms were charging customers up to 100% more for leaving it until the last minute to renew. Martin Lewis told ITV’s Tonight programme previously: “It seems absolutely ridiculous but insurance pricing is all about actuarial risk.

“And what their risk shows them is the type of people who get car insurance early are a lower risk so they give them a lower price. You might pay nearly double if you wait until the last minute to get your car insurance.”