Martin Lewis gives rule to avoid all inheritance tax legally with unlimited rule | Personal Finance | Finance

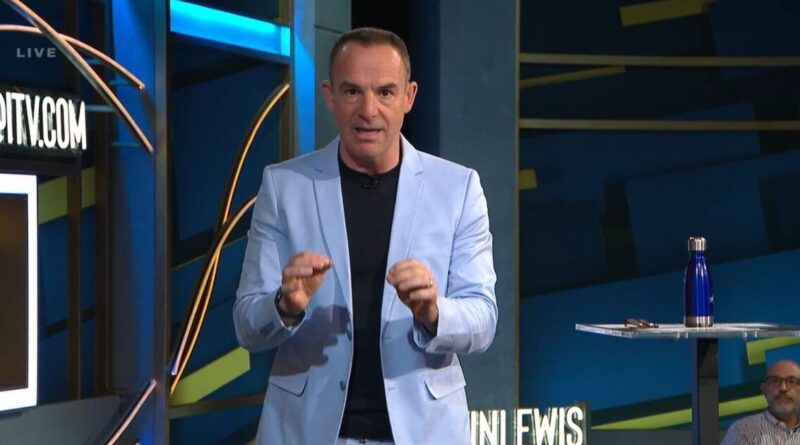

Money expert Martin Lewis has given a cast iron rule that will allow people to avoid all inheritance tax legally. The Money Saving Expert founder returned to the latest episode of The Martin Lewis Show Live on Tuesday night where he took viewers through the intricacies of inheritance tax.

The much hated tax on the assets and cash you leave behind when you die has been the subject of controversy of late after plans to soften some of the special allowances currently used as tax saving vehicles by farmers, as well as the announcement that pensions will begin to be subject to inheritance tax too. But, Martin Lewis has explained that it’s actually very easy to avoid inheritance tax completely legally – – and all you need is to be married or in a civil partnership.

But not only can you leave an unlimited amount of money to your spouse without paying tax on it, you can also pass on your tax personal allowances too, letting your spouse leave more when they die as well without paying tax on it.

Speaking on the ITV1 show, Martin said: “Rule number one: the first thing is there is no inheritance tax on anything left between spouses. Married or civil partners, not just living together.

“Even if you are Bruce Wayne leaving £100billion to your husband or wife, you do not, there is no inheritance tax paid on that whatsoever. Most of you probably know that.

“Here’s the one that people don’t know that has even bigger impact for many people in practice.

“The second rule: you can leave any unused allowance to your spouse (married or civil partner again, only).”

*** Ensure you get our latest personal finance headlines appearing at the top of your Google Search every time by making us a Preferred Source. Go here to activate or add Express as a Preferred Source in your Google search settings ***

Martin explained with an illustration of a married couple with a combined £1M of assets, divided into £500,000 each (though it can be split any way).

One of them dies, and leaves everything to the other. There’s no inheritance tax to pay, and the wife/husband then inherits the other’s allowance added to their own.

“She’s got £650,000 she can leave straight, and £350,000 that she can leave to direct descendants on a house. Which means together, their £1M assets, assuming they’re leaving the house to direct descendants, is totally free of inheritance tax. £1M.”

The Martin Lewis Money Show Live February 10 episode is still available to watch via catchup service ITVX.